Introduction: China’s Xi urges global CEOs to protect trade as Trump tariffs loom

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Anxiety over Donald Trump’s plan to announce a barrage of tariffs on trading partners next week is gripping the global economy, and the markets.

China’s president Xi Jinping has gathered a group of top chief executives in Beijing today, where he urged them to protect industrial and supply chains, as the trade war with the US deepens.

The gathering includes AstraZeneca’s boss Pascal Soriot, Bill Winters of Standard Chartered, Bridgewater’s Ray Dalio and Stephen Schwarzman of Blackstone, plus the CEOs of FedEx, Saudi Aramco, Toyota, Mercedes-Benz, HSBC and Hitachi.

Xi urged the assembled bigwigs,

“We need to work together to maintain the stability of global industrial and supply chains, which is an important guarantee for the healthy development of the world economy”

Around 40 executives joined the meeting, held at the Great Hall of the People in Beijing, Reuters reports.

Xi told them that overseas firms play an important role in China’s economy:

“Foreign enterprises contribute one-third of China’s imports and exports, one-quarter of industrial added value and one-seventh of tax revenue, creating more than 30 million jobs.

And he took a swipe at the trade barriers imposed by other countries in recent years, saying:

“In recent years, foreign investment in China has also been interfered with by geopolitical factors… I often say that blowing out other people’s lights does not make you brighter.”

The meeting comes less than a week before Trump’s “Liberation Day”, when he is expected to announced a wide-ranging slate of reciprocal tariffs. That could disrupt global trade flows, and push up the cost of imports to the US.

Asia-Pacific stock markets have dropped today, with China’s CSI 300 down 0.44% and South Korea’s Kospi losing 2%.

Auto companies contined to be hit by the 25% tariffs announced by Trump on Wednesday, with Hyundai Motors falling another 3.5% today.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says sentiment remains sour due to intensifying tariff talk.

The carmakers around the world got hammered this week as the ones that produce their cars outside the US will cost 25% more if the levies go live – and nearly half of vehicles sold in the US are reportedly assembled elsewhere – and, the ones that are made in the US have at least 20% of their components coming from outside the US.

Evercore ISI predicts that US car prices will likely increase by $3000-4000 on average.

The agenda

-

7am GMT: UK GDP quarterly national accounts, October to December 2024

-

7am GMT: GB retail sales report for February

-

12.30pm GMT: US PCE inflation report for February

-

2pm GMT: University of Michigan’s US consumer confidence report

Key events

US PCE inflation measure rises

A closely watched measure of inflation in the US has risen higher, suggesting cost of living pressures in America are rising even before new tariffs kick in.

The core PCE price index rose by 2.8% in February, up from 2.6% in January, and higher than expected.

Core PCE is the Federal Reserve’s preferred inflation measure, so this may deter them from cutting US interest rates soon, especially as US firms may soon be passing on more new tariffs on imports to consumers.

The report also shows that US personal incomes rose by 0.8% in February, due to a pick-up in wages.

But inflation-adjusted consumer spending only edged up 0.1%, with households choosing to save more instead. That could be a drag on economic growth.

Thames Water’s CFO departs

Troubled UK utility firm Thames Water has just announced the imminent departure of its finance chief, at a crucial time for the company.

Alastair Cochran, Thames’s chief financial officer, will step down from his role “at the end of March 2025”, which doesn’t give him much time to clear his desk!

Cochran’s departure comes just a few weeks after Thames Water secured a £3bn emergency loan to restructure its business, giving it more time to avoid falling into administration.

But it also come as the company, which has nearly £20bn in debt, is in talks with six bidders about a possible takeover.

Thames Water Utilities Limited’s chairman, Sir Adrian Montague says:

“On behalf of the Board I would like to offer our sincere thanks to Al for his service. He has overseen significant changes to the Company during his time on the Board and Executive.

At the request of the Board, alongside his role as CFO, he served as joint CEO maintaining stability for the business before the appointment of the current Chief Executive.

He has led the work to put TWUL’s finances on a more stable footing, overseeing the first stages of our equity raise and financial restructuring, laying the foundations for the wholesale recapitalisation of the business. We wish him the very best for the future.”

Thames hasn’t, yet, got a permanent replacement for Cochran. Instead, it has asked its Director of Group Finance, Stuart Thom, to act as interim CFO “whilst longer term arrangements are put in place”.

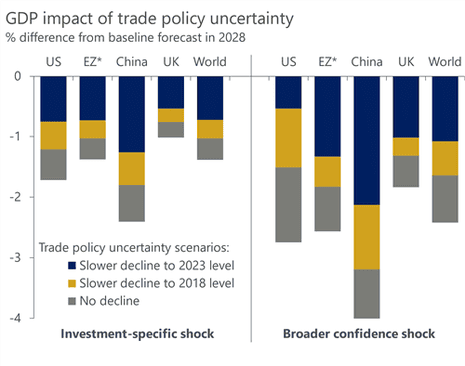

Tariff uncertainty ‘could wipe 2.4% off world economy’

Uncertainty over the US-driven trade war risks spilling over and depressing consumer sentiment and financial markets, a new report has warned, with a severe impact on global growth.

In a new report ahead of President Trump’s self-proclaimed “Liberation Day” next Wednesday, Oxford Economics have examined the impact of high uncertainty over tariffs.

Their work shows that prolonged tariff uncertainty would lower global GDP by 0.7% to 1.7% by 2028, but that hit would be larger – knocking up to 2.4% off the world economy – if financial markets and consumer sentiment were also depressed.

The report says:

“The recent US stock market correction appears to have been partially triggered by investors realising that Trump may follow through with his tariff threats and that this will hurt the US economy. Similarly, consumer sentiment has weakened due to tariff-induced inflation fears.”

“Should continuing policy uncertainty depress financial markets and consumer sentiment more severely, above and beyond the recent US stock market correction, we estimate the drop in global GDP would be significantly larger – ranging from -1.1% to -2.4% in 2028.”

Over in Berlin, a German government spokesperson has declared that “nothing is off the table” with regards to potential responses to the threat of US tariffs.

Asked whether countermeasures could target U.S. tech companies, the spokesperson said “at the moment, nothing is off the table, but instead everything is being looked at.”

He added:

“Decisions must be made jointly and in consideration of the costs and benefits within the European Union and under the leadership of the European Commission – this process is under way.”

Back in Beijing, Sean Stein, president of the U.S.-China Business Council, has been discussing today’s meeting between president Xi and global CEOs.

Stein says:

“The CEOs I spoke with, and I spoke with a lot of them, felt it was worth it.

“Not only did the president acknowledge various challenges facing companies and industry, in many cases he pledged the government would take action.”

During the meeting, Xi urged global business leaders to push back against protectionism, saying:

“Some countries are building a small yard with high fences, erecting tariff barriers, politicizing business issues, using them as tools and weapons.

I hope you will share your sensible views and take actions to push back against the retrogressive rules and the zero-sum games.

Mark Sweney

Chelsea FC owner and chairman Todd Boehly is considering making a bid for the owner of the Scotsman and Yorkshire Post, in a move seen as a pre-cursor to making a potential offer for The Telegraph.

National World, the London-listed owner of more than 100 regional titles, said that it had received confirmation that Boehly-controlled Eldridge Media Holdings (EMH) is considering making a proposal to buy the company.

Boehly has been in talks with David Montgomery, the former boss of the parent of the Mirror and executive chairman of National World, about a potential tie-up to buy the Daily and Sunday Telegraph which has been up for sale for almost two years.

Montgomery’s National World, which was an underbidder in the protracted auction of the Telegraph titles, is currently in the process of a shareholder-approved takeover by its largest investor.

“The company acknowledges, for the purposes of the takeover code, that it is in receipt of an approach from EMH regarding a possible offer for the entire issued and to be issued share capital of the company,” said National World in a statement to markets on Friday.

“The National World board will consider the terms of any proposal put forward by EMH that may deliver superior value to National World shareholders than the scheme [of arrangement relating to the current sale process]”.

Boehly and Montgomery have been in talks about a potential deal that would combine National World and the Telegraph titles, and also involve other third-party backers, at a price below the £500m-plus level being sought by the Telegraph’s current backers.

RedBird IMI, which drives most of its funding from Sheikh Mansour bin Zayed Al Nahyan, the vice-president of the UAE and owner of Manchester City football club, paid £600m to take control of Telegraph Media Group in November 2023 from the Barclay family.

However, RedBird IMI was forced to put the titles back up for sale in the spring after the British government published legislation to block foreign states or associated individuals from owning newspaper assets in the UK.

Dovid Efune, the British owner of the New York Sun, had several weeks of exclusivity late last year to push through a £550m deal to buy the titles.

However, Efune has so far failed to raise the financial backing to get the deal over the line and RedBird IMI is pursuing talks with other potential bidders.

MPs demand answers over faulty ONS data

Newsflash: MPs have raised fresh concerns with the UK’s Office for National Statistics over its failure to produce accurate data.

The Treasury committee are demanding answers from the ONS about “the latest troubling errors and delays in trade data and Producer Price Index data”, which they say will widen concerns about how reliable ONS data is.

Dame Meg Hillier MP, chair of the Treasury Committee, has asked national statistian Sir Ian Diamond to explain what’s going on.

She wants to know:

-

the nature and cause of the errors identified in the trade data, why the errors were revealed now, and when the ONS first had knowledge of the errors;

-

the nature and cause of the “problem” identified with the Producer Price Index (PPI) and Services Producer Price Index (SPPI) methodology, why the problem was revealed now, and when the ONS first had knowledge of the problem;

-

your latest assessment of the impact on the PPI and SPPI and the impact on linked data series, such as GDP; and

-

when you expect publication to resume, and when you expect the PPI and SPPI to be restored to full quality

January’s trade data was delayed by two weeks, until this morning, and shows a small widening in the UK’s trade in goods deficit.

The ONS warned last week that there are errors in its growth figures after spotting problems with the ‘factory gate’ price data (PPI) it uses to calculate the size of Britain’s economy. PPI data has now been suspended, which means we can’t tell how much UK manufacturers are raising, or lowering, prices by.

This comes on top of the well-known problems with the ONS’s labour force data, which led to Diamond being hauled before the Treasury Committee last month. He told MPs that more money would help lift the response rates to the ONS’s surveys, which have slumped since the pandemic.

Rise in UK house purchases in February ahead of stamp duty changes

Property transactions across the UK jumped last month, as first time buyers rush to avoid the rise in stamp duty coming in April.

HMRC reports that there were 108,250 UK residential transactions in February, which is 13% more than in January and 28% higher than February 2024.

This suggests that first-time buyers brought forward their purchasing decisions to avoid the increase in stamp duty from 1 April, when the threshold at which first-time buyers start paying stamp duty will return to £300,000, from the current rate of £435,000.

UK monthly property transactions got a stamp duty bump as buyers rushed to complete in February 2025 before the taxation holiday came to a close. UK residential transactions in February 2025 were 28% higher than February 2024 and 13% higher than January 2025 at 108,250. pic.twitter.com/L1kbQfN2vr

— Emma Fildes (@emmafildes) March 28, 2025

Tom Bill, head of UK residential research at Knight Frank, said:

“The jump in February proves that nothing moves the UK housing market quite like a change in stamp duty. We expect a similar increase in March but what happens next will be more important in assessing the health of the property market.

The underlying reality feels reasonably stable but there are still risks in the shape of persistent inflation and stubbornly-high mortgage rates, unpredictable US trade policy and an autumn budget where speculation will focus on tax rises. We expect UK prices to rise by 2.5% this year.”

World leaders are continuing to react to Donald Trump’s imposition of a 25% tariff on car imports, and the looming “Liberation Day” levies expected next week.

India is attempting to placate the US president, by offering tariff cuts on imports of U.S. farm products like almonds and cranberries.

In a series of meeting in New Delhi with Brendan Lynch, the assistant U.S. trade representative for South and Central Asia, India agreed to cut tariffs on bourbon whiskey and agricultural products such as almonds, walnuts, cranberries, pistachios and lentils, Reuters reports.

Other leaders are less conciliatory, with Canada’s prime minister, Mark Carney, warning yesterday that the era of deep ties with the US “is over”.

Spain’s prime minister Pedro Sanchez has today called on the US administration to reconsider new tariffs on goods imported from Europe.

Over in Germany, the number of people out of work has risen at the fastest rate since October of 2024.

The German labour office said the number of unemployed increased by 26,000 in seasonally adjusted terms to 2.92 million. Analysts polled by Reuters had expected that figure to rise by 10,000.

The seasonally adjusted jobless rate rose to 6.3% from 6.2% the previous month, slightly higher than forecast.

Andrea Nahles, the head of the labour office, says:

“March marks the start of the so-called spring recovery on the labour market. This year, however, the economic slump is noticeably slowing it down.”

UK households boosted savings in Q4 2024

Today’s UK national accounts data also shows that people stashed away more of their money into savings at the end of last year.

The household saving ratio, which measure the proportion of income that is saved, rose to 12% in October-December 2024, up from 10.3% in the third quarter of last year.

That looks to be the highest savings ratio since the second quarter of 2021, when people were unable to get out and spend due to the Covid-19 pandemic lockdowns.

Increased savings suggests consumers were nervous about the economic outlook, and chose to stash cash rather than splash out on new purchases – which will have held back economic growth in the quarter.

People also had more money to spend, or save, as real households’ disposable income (RHDI) per head increased by 1.7% in Quarter 4 2024, up from 0.6% growth in the previous quarter.

Ruth Gregory, deputy chief UK economist at Capital Economics, says:

One bright spot was the impressive 1.9% q/q (CE forecast 0.7% q/q) rise in consumers’ real incomes in Q4. The 4.2% rise in 2024 as a whole suggests households experienced the strongest real income growth in nine years.

With consumer spending hardly rising, at 12.0% in Q4 (up from 10.3% in Q3), the saving rate remains unusually high, suggesting households are choosing to save rather than spend the bulk of those gains.

British retail sales rose 1% in February, ONS says

Retail sales across Great Britain picked up for the second month running in February, new data shows.

The Office for National Statistics has reported that retail sales volumes rose by 1.0% in February 2025, following a 1.4% increase in January, and a 0.5% drop in December

According to the ONS, there was a strong pick-up in spending at non-food stores.

The report says:

Non-food stores – the total of department, clothing, household and other non-food stores – rose by 3.1% over the month. This put monthly sales volumes at their highest level since March 2022.

The ONS’s data is seasonally adjusted – an attempt to strip out factors that might push sales up or down, such as Christmas. So it can be hard to pick out exactly what’s going on.

Matt Swannell, chief economic advisor to the EY ITEM Club, says:

“The exceptional volatility in recent retail sales outturns has made it difficult to identify underlying trends. In each of the past two years, sales in food stores have slumped in December, risen markedly in January, then fallen back again in February. Sales figures for non-food stores have also been exceptionally volatile in recent months.

We suspect this reflects a combination of seasonal adjustment problems and the fact that retail sales data can be very noisy. It appears unlikely that the recent strength is indicative of a strong improvement in the underlying performance of the sector, and we expect sales to fall back in the coming months.

The broader picture is that sales volumes rose by 0.3% in the three months to February 2025, compared with the three months to November 2024, and by 2.0% year-on-year.

European stock markets have dropped at the start of trading, adding to yesterday’s losses, but the UK’s FTSE 100 is faring better.

Germany’s DAX has dropped by 0.7%, and France’s CAC has lost 0.45%.

The FTSE 100 is flat, though.

Richard Hunter, head of markets at interactive investor, says:

“The Trump dump rumbled on, with investors reluctant to take new positions following the latest carmaker tariff trauma and an important week to come.

Shares in carmakers across the globe slammed into reverse following the White House announcement of a 25% tariff on imported cars, which domestically wiped 7% from General Motors shares and some 4% from Ford. The sector is now frantically revising its strategy, with the possibility of moving manufacturing hubs to deal with the new taxes. In any event, questions remain around the impact on supply chains which are intertwined globally, perhaps leading to the inevitable conclusion that car prices will simply have to rise in response. Ironically, there was some strength in shares which deal in used cars as an alternative to these potentially higher prices.

Elsewhere, comments from Federal Reserve officials recognised that the likelihood of a new round of inflation was becoming more entrenched, suggesting that interest rates would stay unchanged until more certainty emerges. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures index, will be released later today, where a rise of 2.5% is expected for February year-on-year, equalling the January number, and 0.3% for the month.

Shares in WH Smith have dropped by 2.4% in early stock market trading in London, as traders digest the sale of its high street stores for £76m.

UK trade deficit widens

Less encouragingly, the UK’s trade deficit has widened.

The total trade deficit, excluding precious metals, expanded to £10.2bn in the last quarter of 2024, up from £6bn in Q3.

The goods deficit widened by £4.8n to £59.5bn, while the services surplus nudged up by £600m to £49.3bn.

The ONS reports that total goods exports fell by £3.5bn in Q4 2024, to £86.4bn.

The largest decreases in exports of goods were recorded in:

ONS chief economist Grant Fitzner says:

“The UK’s current account deficit with the rest of the world widened slightly in the latest quarter, driven by falling exports of goods.

Our balance of payments statistics for recent years have been updated to incorporate improved measurement of foreign direct investment and corrected trade data.”

UK growth stronger than expected in 2024

We also have confirmation this morning that Britain avoided recession last year.

The Office for National Statistics has confirmed that UK GDP rose by 0.1% in October-December, matching the earlier estimate, following no growth in July-September.

But the ONS has also revised up its earlier data – it now estimates the economy grew by 1.1% in 2024, up from an initial estimate of 0.9% growth. That’s because it has raised its forecast for GDP in Q4 2023, and the first two quarters of 2024, a little.

GDP is estimated is estimated to have increased by 0.1% in Quarter 4 (Oct to Dec) 2024, unrevised from the first estimate. It has been revised upwards 0.1 pp in each of Q4 2023 to Q2 2024 inclusive.

Read more ➡️ https://t.co/zPMvvOOwA3 pic.twitter.com/uAxQgLAolU

— Office for National Statistics (ONS) (@ONS) March 28, 2025

ONS chief economist Grant Fitzner explains:

“Today’s updated GDP estimates indicate that the economy grew slightly more strongly in the first half of last year than previously estimated but continues to show little growth since last summer.

“The household saving ratio increased again this quarter, with the contribution of non-pension saving at the highest rate on record outside the period affected by the pandemic.

However, the picture is less cheerful once you adjust for population changes.

Real GDP per head is estimated to have fallen by an unrevised 0.1% in Quarter 4 2024 and showed no growth across all of 2024 (revised up from the first estimate fall of 0.1%), the ONS says.

Photos: Xi meets business chiefs

Photos from China’s President Xi Jinping’s meeting with global business leaders today show that the CEOs of major financial groups, carmakers and other manufacturers were in attendance:

WH Smith sells UK high street business for £76m

Newsflash: WH Smith has agreed to sell its UK high street chain to Modella Capital, in a deal that will see the stores rebranded as “TG Jones”.

The deal will allow WH Smith to streamline its operations and create a retailer focused on global travel, via its outlets at railway stations and airports.

The deal values WH Smith’s 480 high-street stores at £76m, with their 5,000 staff transferring to Modella under the deal.

Carl Cowling, chief executive of WH Smith, says the deal is “a pivotal moment” for the company, adding:

“We have a highly successful Travel business, operating in fast growing markets in 32 countries and we are constantly innovating to deliver strong returns and meet our customers’ and partners’ needs. Our Travel business currently accounts for around 75% of the Group’s revenue and 85% of its trading profit. With the ongoing strength in our UK Travel division, and the scale of the growth opportunities in both North America and the Rest of the World, we are in our strongest ever position to deliver enhanced growth as we move forward as a pure play travel retailer.

“As our Travel business has grown, our UK High Street business has become a much smaller part of the WHSmith Group. High Street is a good business; it is profitable and cash generative with an experienced and high-performing management team.

However, given our rapid international growth, now is the right time for a new owner to take the High Street business forward and for the WHSmith leadership team to focus exclusively on our Travel business. I wish the High Street team every success.

Introduction: China’s Xi urges global CEOs to protect trade as Trump tariffs loom

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Anxiety over Donald Trump’s plan to announce a barrage of tariffs on trading partners next week is gripping the global economy, and the markets.

China’s president Xi Jinping has gathered a group of top chief executives in Beijing today, where he urged them to protect industrial and supply chains, as the trade war with the US deepens.

The gathering includes AstraZeneca’s boss Pascal Soriot, Bill Winters of Standard Chartered, Bridgewater’s Ray Dalio and Stephen Schwarzman of Blackstone, plus the CEOs of FedEx, Saudi Aramco, Toyota, Mercedes-Benz, HSBC and Hitachi.

Xi urged the assembled bigwigs,

“We need to work together to maintain the stability of global industrial and supply chains, which is an important guarantee for the healthy development of the world economy”

Around 40 executives joined the meeting, held at the Great Hall of the People in Beijing, Reuters reports.

Xi told them that overseas firms play an important role in China’s economy:

“Foreign enterprises contribute one-third of China’s imports and exports, one-quarter of industrial added value and one-seventh of tax revenue, creating more than 30 million jobs.

And he took a swipe at the trade barriers imposed by other countries in recent years, saying:

“In recent years, foreign investment in China has also been interfered with by geopolitical factors… I often say that blowing out other people’s lights does not make you brighter.”

The meeting comes less than a week before Trump’s “Liberation Day”, when he is expected to announced a wide-ranging slate of reciprocal tariffs. That could disrupt global trade flows, and push up the cost of imports to the US.

Asia-Pacific stock markets have dropped today, with China’s CSI 300 down 0.44% and South Korea’s Kospi losing 2%.

Auto companies contined to be hit by the 25% tariffs announced by Trump on Wednesday, with Hyundai Motors falling another 3.5% today.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says sentiment remains sour due to intensifying tariff talk.

The carmakers around the world got hammered this week as the ones that produce their cars outside the US will cost 25% more if the levies go live – and nearly half of vehicles sold in the US are reportedly assembled elsewhere – and, the ones that are made in the US have at least 20% of their components coming from outside the US.

Evercore ISI predicts that US car prices will likely increase by $3000-4000 on average.

The agenda

-

7am GMT: UK GDP quarterly national accounts, October to December 2024

-

7am GMT: GB retail sales report for February

-

12.30pm GMT: US PCE inflation report for February

-

2pm GMT: University of Michigan’s US consumer confidence report

未能结束美国SEC欺诈案-350x250.jpeg)