Key takeaways

-

Stablecoin attestation reports provide third-party verification that each token is backed by real-world assets like cash and US Treasurys.

-

Attestation ≠ audit: Attestations are point-in-time checks, not deep financial audits, so users should still perform broader due diligence.

-

Not all tokens are redeemable. Time-locked, test or frozen tokens are excluded from reserve calculations to reflect only actively circulating coins.

-

USDC sets an industry benchmark with regular third-party attestations, transparent reserve reporting and compliance with MiCA regulations.

Stablecoins play a crucial role in the digital asset ecosystem, bridging traditional fiat currencies and the decentralized world of cryptocurrencies.

How can you be confident that each stablecoin is backed by real-world assets? This is where stablecoin attestation reports come in.

Understanding how to read attestation reports is essential for anyone interacting with stablecoins like USDC (USDC) or Tether USDt (USDT).

This guide explains everything you need to know about stablecoin attestation reports, how they work and why they matter.

What is a stablecoin attestation report?

A stablecoin attestation report is a formal document issued by an independent third party — a certified public accountant (CPA) firm — that verifies whether the stablecoin issuer holds sufficient reserves to back the coins in circulation.

Unlike full audits, which evaluate broader financial systems and controls, attestations are narrower in scope. They confirm specific facts, like whether reserve balances match circulating supply at a single point in time.

Think of an attestation as a snapshot taken by accountants saying, “Yes, we’ve checked, and the money is there right now.”

It’s not as deep or wide as an audit, but it still builds trust.

For example, if a stablecoin issuer claims that each token is backed 1:1 by US dollars, an attestation report would provide evidence supporting that claim. Stablecoins like USDC regularly publish such reports to prove that their coins are fully backed, helping to build trust in their ecosystem.

Attestation reports are especially critical for investors and institutions that depend on stablecoins for cross-border settlements, collateral in lending protocols and participation in decentralized finance (DeFi) applications. Without confidence in the reserves’ authenticity, the stablecoin system risks collapse, which can impact the broader crypto market.

Purpose of stablecoin attestations: Why transparency matters?

Transparency is essential in the crypto space, especially for stablecoins, which serve as a medium of exchange, a store of value and collateral on DeFi platforms. Attestation reports offer a window into a stablecoin issuer’s reserves and disclosure practices, allowing users, regulators and investors to evaluate whether the issuer is operating responsibly.

Issuers like Circle, the company behind USDC, publish attestation reports to demonstrate compliance with regulatory expectations and assure users that the coins they hold are not only stable in name but also in substance. In doing so, they promote stablecoin investor safety and support market integrity.

This transparency builds the foundation for regulatory trust and helps attract traditional financial institutions into the space. It also aligns with broader industry goals for increasing stablecoin compliance, particularly as governments worldwide explore stablecoin-specific regulations.

Who conducts the attestation?

Stablecoin attestation reports are prepared by independent accounting firms. For instance, Circle’s USDC attestation reports are conducted by Deloitte (as of April 13, 2025), a leading global audit and advisory firm. These firms follow professional standards set by bodies like the AICPA (American Institute of Certified Public Accountants).

Independent attestors are essential because they remove conflicts of interest. Having a third-party review reserves ensures that the information is unbiased, credible and aligned with global assurance standards.

AICPA’s 2025 criteria: Standardizing stablecoin attestations

In response to growing concerns over inconsistent stablecoin disclosures, the AICPA introduced the 2025 Criteria for Stablecoin Reporting, a standardized framework for fiat-pegged, asset-backed tokens.

These criteria define how stablecoin issuers should present and disclose three key areas:

-

Redeemable tokens outstanding.

-

The availability and composition of redemption assets.

-

The comparison between the two.

What makes the 2025 Criteria important is its emphasis on transparency and comparability. For example, token issuers must clearly define redeemable versus nonredeemable tokens (such as time-locked or test tokens), identify where and how reserves are held and disclose any material legal or operational risks affecting redemption.

By aligning attestation reports with this framework, accounting firms ensure that evaluations are conducted using suitable, objective and measurable criteria, a key requirement under US attestation standards. This gives investors, regulators and DeFi users a more consistent and reliable basis for evaluating stablecoin solvency and trustworthiness.

As adoption grows, the 2025 Criteria may become the industry benchmark, especially as regulatory bodies increasingly rely on standardized reporting to assess stablecoin risks and enforce compliance.

Did you know? Not all stablecoins in circulation are redeemable. Some, like time-locked tokens, are temporarily restricted and can’t be accessed until a specific date. Others, known as test tokens, are used only for internal system testing and are never meant to be redeemed. These tokens are excluded from reserve calculations in attestation reports to ensure an accurate picture of what’s backing user-accessible stablecoins.

Behind the peg: How to read a stablecoin report and spot real backing

Reading a stablecoin attestation report isn’t just about scanning numbers. It’s about knowing whether the stablecoin you’re holding is backed.

Here’s how to break it down step by step and spot what really matters:

-

Check the report date: Attestations are point-in-time reviews. Look for the exact date the report covers (e.g., Feb. 28, 2025). It confirms reserves on that day only, not before or after.

-

Compare circulating supply vs reserves: Find the number of tokens in circulation and the total value of reserves. The reserves should be equal to or greater than the supply. If not, that’s a red flag.

-

Look at what backs the reserves: Reserves should be held in safe, liquid assets like US Treasurys or cash in regulated financial institutions. Watch out for risky or vague asset descriptions.

-

Review custodian and asset details: Check who’s holding the funds (e.g., major banks or money market funds) and where they’re stored. Remember, reputable custodians add credibility.

-

Understand the methodology: The report should explain how the review was conducted, what data was verified, what systems were used and which standards (like AICPA) were followed.

-

Identify excluded tokens: Some tokens, like test tokens or time-locked tokens, are excluded from circulation counts. Look for notes explaining these exceptions.

-

Check who performed the attestation: An independent and recognized accounting firm (like Deloitte or Grant Thornton) adds legitimacy. If the attestor isn’t disclosed or independent, treat with caution. A signed statement from the accounting firm verifies the accuracy of the issuer’s claims.

Investors may also look for supplementary notes within the report, such as jurisdiction of reserve accounts, legal encumbrances on assets or clarification of valuation techniques. All these elements help paint a fuller picture of risk and reliability.

What the February 2025 USDC attestation report reveals

In March 2025, Circle released its latest reserve attestation report, offering a transparent look at what backs one of the most widely used digital dollars in crypto.

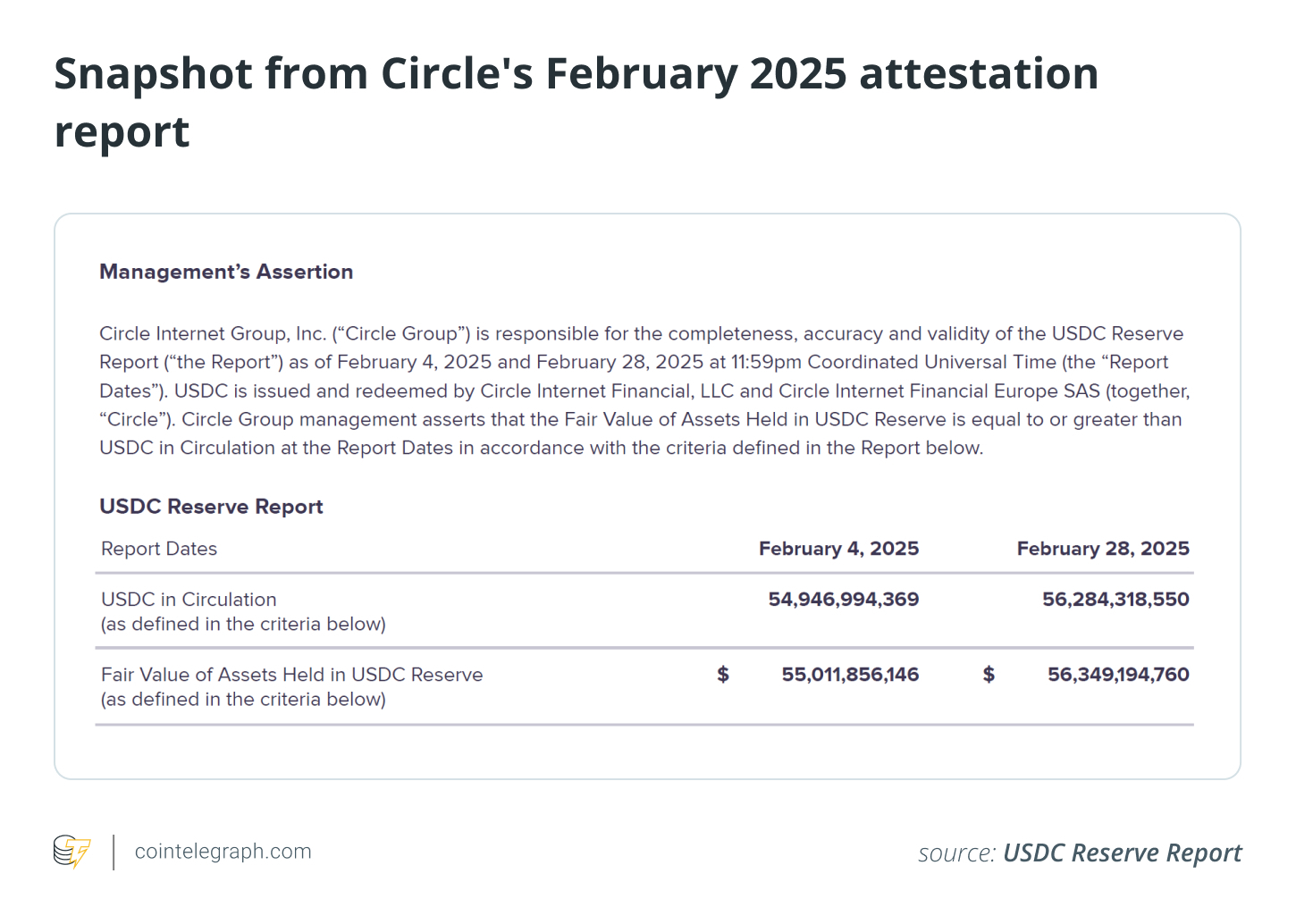

The report was independently examined by Deloitte, one of the “Big Four” global accounting firms. Deloitte confirmed that, as of both Feb. 4 and Feb. 28, 2025, the fair value of Circle’s reserves was equal to or greater than the amount of USDC in circulation.

The below snapshot from Circle’s February 2025 attestation report shows that the amount of USDC in circulation stood at $54.95 billion on Feb. 4 and $56.28 billion on Feb. 28. The fair value of reserves held to back USDC exceeded these figures, totaling $55.01 billion and $56.35 billion on the respective dates.

What’s in the reserves?

Circle holds its USDC reserves mainly in:

These assets are kept separate from Circle’s corporate funds and are managed through the Circle Reserve Fund, a regulated money market fund.

The attestation also accounts for technical factors like “access-denied” tokens (e.g., frozen due to legal or compliance reasons) and tokens not yet issued, ensuring an accurate measure of circulating USDC.

For users, this means greater confidence that every USDC token is backed by high-quality, liquid assets, just like the company claims.

Did you know? As of Feb. 4 and Feb. 28, 2025, 993,225 USDC remained permanently frozen on deprecated blockchains, including the FLOW blockchain. These tokens are excluded from the official USDC in circulation totals reported by Circle.

How are stablecoin reserves verified?

Stablecoin attestation reports serve as a form of proof of reserves, providing independent confirmation that a stablecoin issuer holds enough assets to back the tokens in circulation. The verification process typically involves several key steps:

-

Reviewing bank statements and financial records.

-

Confirming cash balances held by custodians.

-

Cross-checking reported reserves with third-party documentation.

-

Comparing the supply of stablecoins onchain with the reported reserve amount.

As mentioned, these procedures are carried out by independent accounting firms and are designed to ensure that the reserves are not only sufficient but also liquid and accessible.

Some attestation reports also include details on the tools and technologies used to maintain transparency, such as real-time API integrations with custodians and onchain monitoring systems. These advancements are helping bridge the gap between traditional finance and blockchain, reinforcing trust through verifiable, tamper-resistant data.

What happens if reserves don’t match supply?

If an attestation report reveals that a stablecoin issuer does not hold sufficient reserves, the consequences can be severe. The issuer may face:

-

Regulatory scrutiny: Noncompliance with financial regulations.

-

Market sell-offs: A drop in user confidence may lead to mass redemptions.

-

Price instability: The stablecoin may lose its 1:1 peg.

These concerns highlight the need for regular, transparent crypto reserve reports. For instance, Tether has faced ongoing criticism for the lack of clarity surrounding its reserves, fueling demands for greater disclosure. This opacity has also led to Tether’s delisting in Europe under Markets in Crypto-Assets (MiCA) regulations as exchanges brace for stricter compliance requirements.

Lack of transparency can also invite speculation and misinformation, which can cause unnecessary panic in the markets. As a result, proactive disclosure is not just a best practice; it’s a business imperative for stablecoin issuers.

Limitations of stablecoin attestation reports

While attestation reports are crucial, they are not a cure-all. Here are some limitations:

-

Point-in-time snapshots: Reports only verify reserves on a specific date.

-

No forward-looking guarantees: Attestations don’t predict future solvency.

-

Limited operational insight: They typically don’t cover risks like hacking, mismanagement or liquidity issues.

For example, the latest USDC attestation (as discussed in this article) confirms full reserves as of Feb. 4 and Feb. 28, 2025, but it says nothing about what happens on March 1 or any day after. Users must understand these limitations and avoid assuming that attestation equals absolute safety.

This is why combining attestation reports with other forms of due diligence like reading legal disclaimers, following regulatory updates and tracking company behavior is key for responsible crypto participation.

Not just a report — A roadmap to trust in crypto

Reading a stablecoin attestation report is more than scanning numbers; it’s a key step in assessing the trustworthiness of a digital asset. By understanding how to read attestation reports, crypto users can make informed decisions, avoid unnecessary risks and support projects that prioritize stablecoin compliance and transparency.

With clearer frameworks from institutions like the AICPA and growing public pressure for stablecoin disclosure practices, the ecosystem is moving toward greater accountability. As regulators sharpen their focus and investors demand more visibility, learning to navigate crypto attestation reports will become an essential skill for all participants in the crypto economy.

Whether you’re a retail investor, developer or institutional player, mastering these reports helps protect your assets and support a more transparent and trustworthy crypto future.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

到Binance-Hodler-Airdrops-120x86.jpg)