Monad is a groundbreaking Layer 1 solution that delivers extreme scalability while maintaining full EVM compatibility. It solves the inherent throughput issues of legacy EVM chains by introducing Optimistic Parallel Execution. This design transforms the blockchain into a high-speed, concurrent processing environment.

What is Monad?

What is Monad?

Monad stands as a revolutionary high-performance Layer 1 blockchain. It tackles the core dilemma facing the decentralized world: the fundamental trade-off between speed, cost, and compatibility. Monad’s central mission is to create a blockchain environment that offers the best of all worlds: the scalability and speed of a Web2 application with the familiar environment and security of the Ethereum Virtual Machine (EVM).

The L1 blockchain positions itself as an evolution of the EVM landscape. By changing the way it handles transactions, Monad aims to process 10,000 transactions per second (TPS), provide almost instant finality in about 800 milliseconds, and keep gas fees extremely low, often just a tiny fraction of a cent.

How It Works

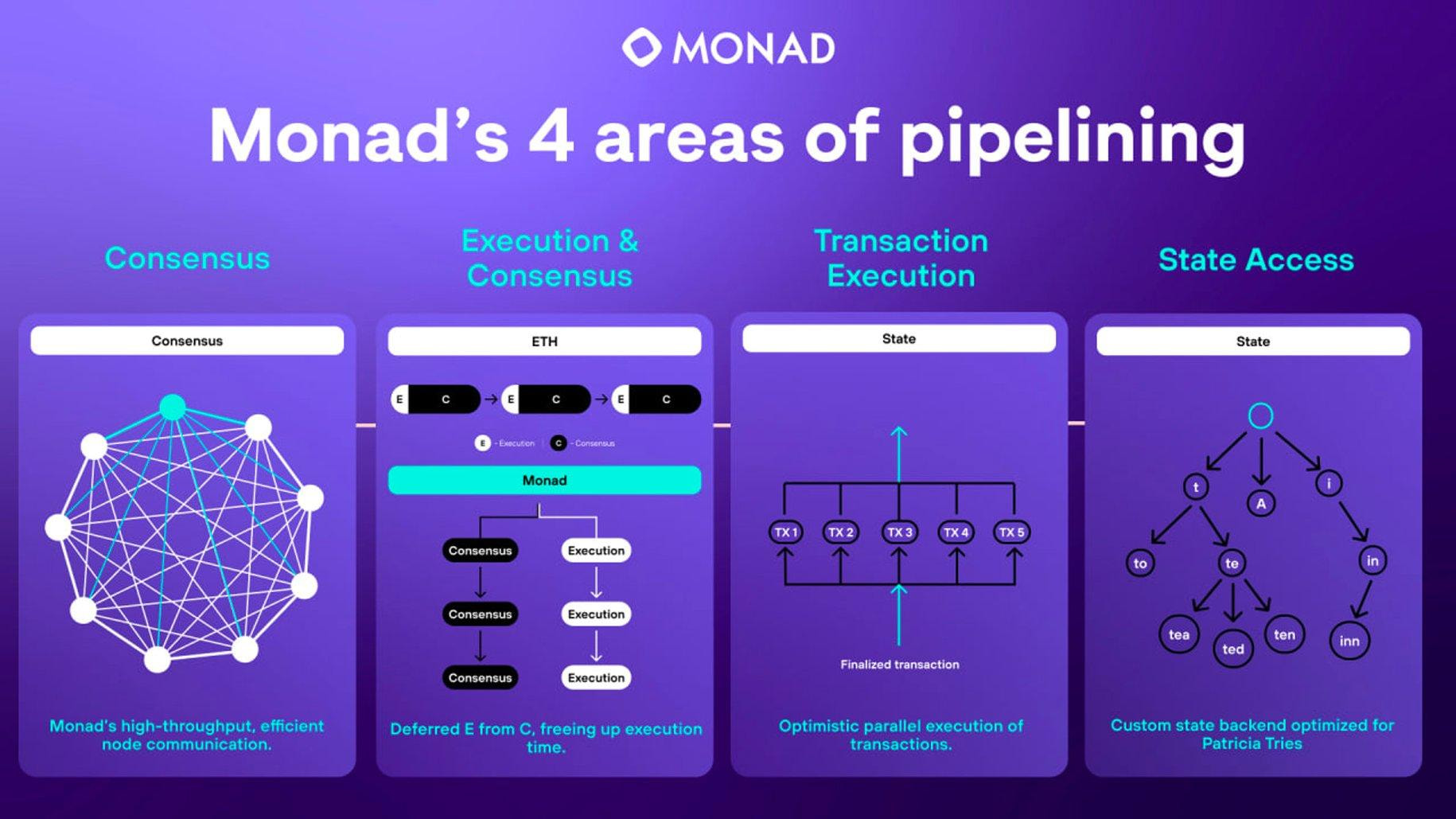

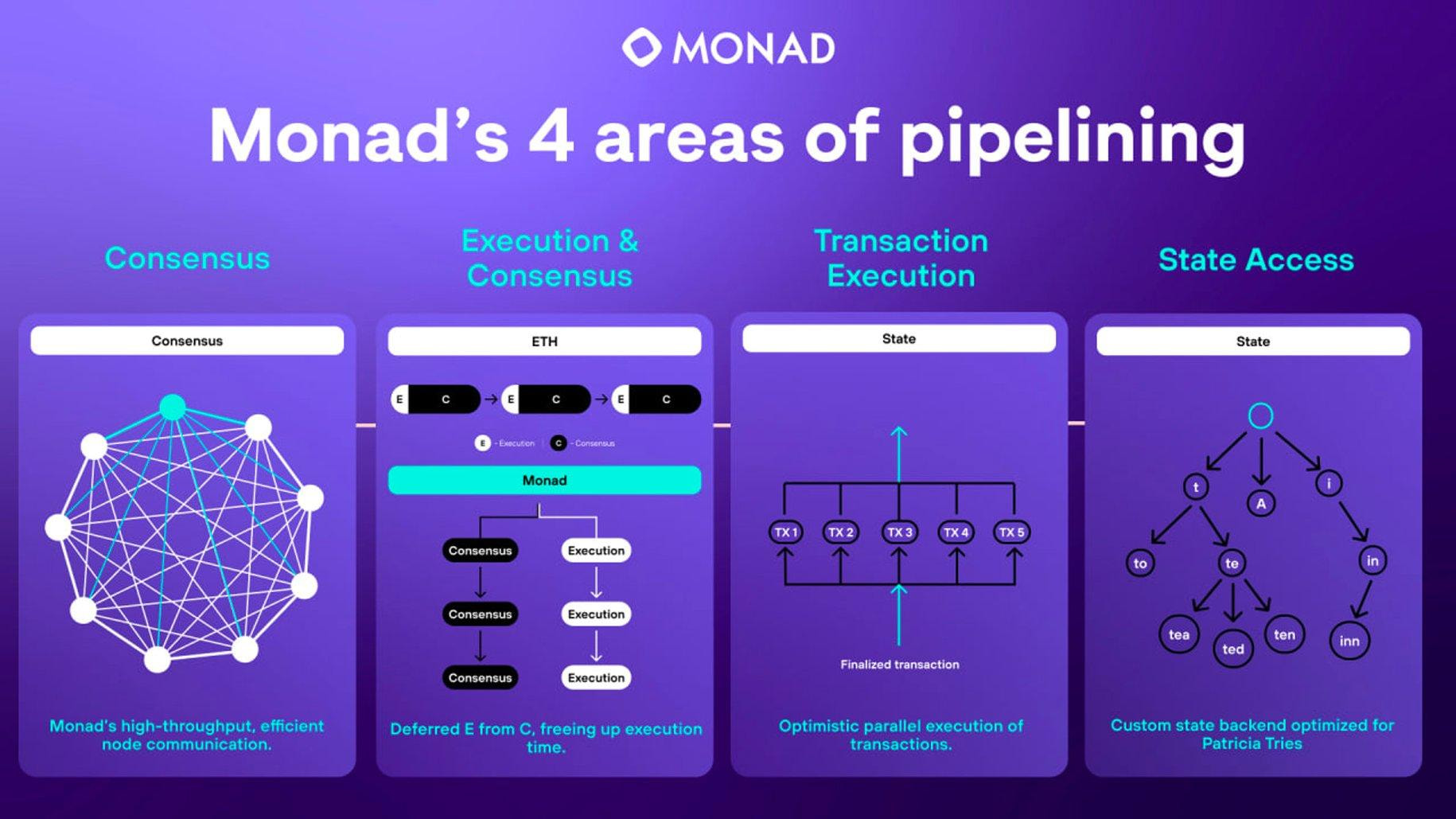

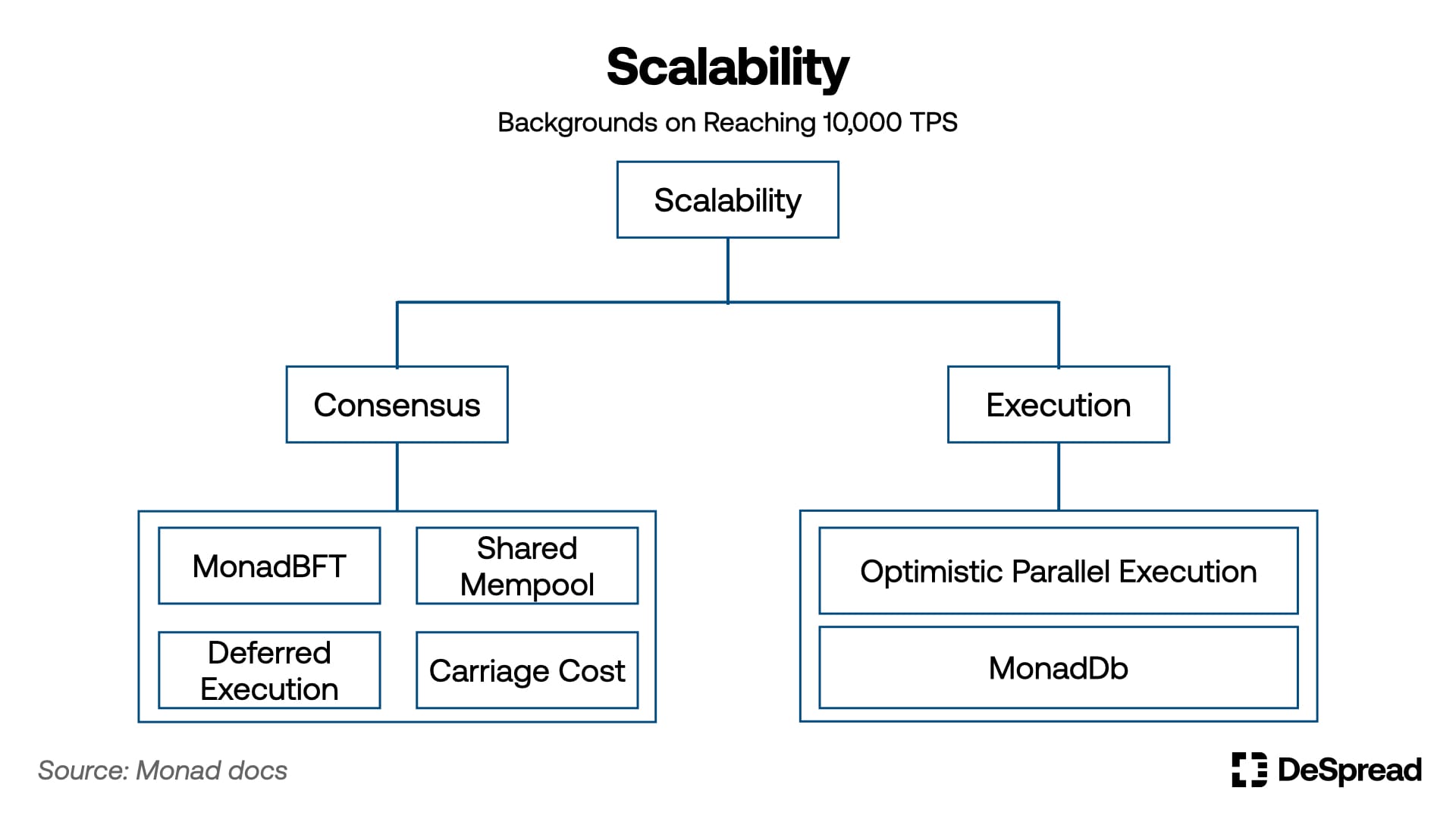

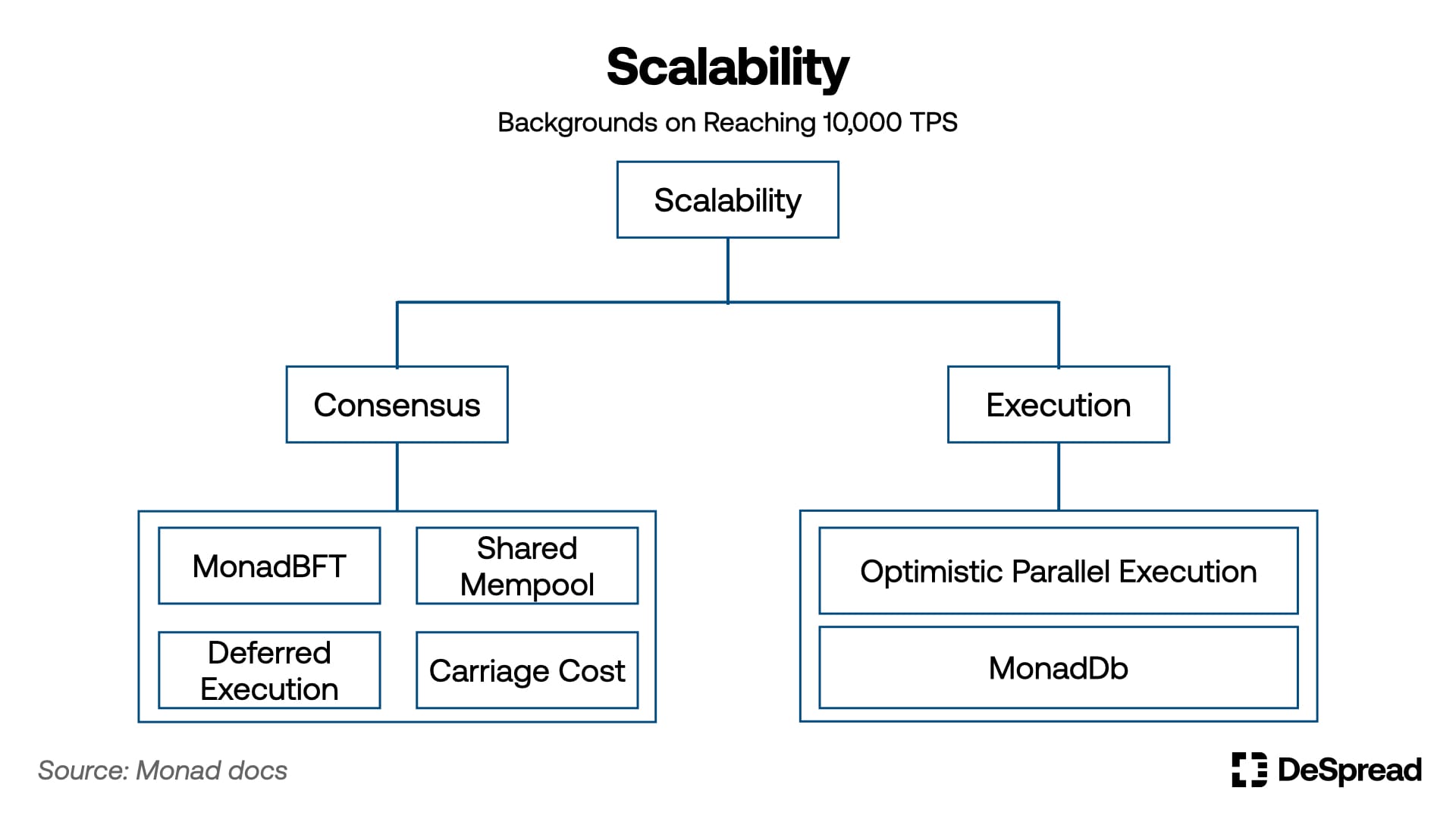

Monad achieves its unprecedented performance through a combination of groundbreaking architectural changes that redefine transaction processing on an EVM-compatible chain. These new features, including Parallel Execution, Asynchronous Execution, and the MonadBFT consensus mechanism, create the powerful engine that drives the network.

Parallel Execution

Traditional EVM blockchains, including Ethereum itself, process transactions sequentially. The blockchain executes one transaction completely before starting the next, ensuring determinism and security, but it also creates the critical bottleneck that limits scalability.

Monad’s Optimistic Parallel Execution shatters the limitation. It operates under an “optimistic” assumption: it assumes most transactions in a block are independent and can run simultaneously without affecting each other. The system attempts to execute multiple transactions in parallel, utilizing multiple CPU cores and virtual machines at once. This significantly speeds up the total execution time for a block.

Monad also employs a static code analyzer. This tool quickly scans the transactions before execution to predict which ones might interact with the same smart contract state (i.e., they have a dependency).

In the rare case where a parallel-executed transaction incorrectly modifies a state that another transaction relies on, the system only needs to reexecute a small number of conflicting transactions sequentially. This intelligent, highly optimized conflict resolution minimizes wasted work, allowing the network to process independent transactions at maximum speed.

The single feature allows Monad to leverage modern computing hardware far more efficiently than its peers. It transforms the single-lane road into a vast, multi-lane highway, multiplying throughput by a factor of 100 or more compared to older EVM designs.

Parallel Execution – Source: Monad

MonadBFT & Single-Slot Finality

Scalability relies on more than just fast execution; it also requires a highly efficient method for validators to agree on the state of the chain. Monad implements MonadBFT, a custom-designed, optimized consensus mechanism derived from the celebrated HotStuff protocol.

- Optimized Byzantine Fault Tolerance (BFT): MonadBFT focuses on efficiency. It streamlines communication between validating nodes and the block leader. Standard BFT protocols often require three communication steps or phases to reach finality; MonadBFT optimizes this, reducing the communication overhead.

- Fast Finality: The primary benefit is speed. MonadBFT allows the network to reach consensus on the finality of a block—meaning a transaction is irreversible—in approximately 800 milliseconds (sub-second finality). This is a dramatic improvement over Ethereum, where finality can take minutes or even longer. For high-frequency applications like decentralized exchanges (DEXs) and payment systems, sub-second finality is a crucial prerequisite for mainstream adoption.

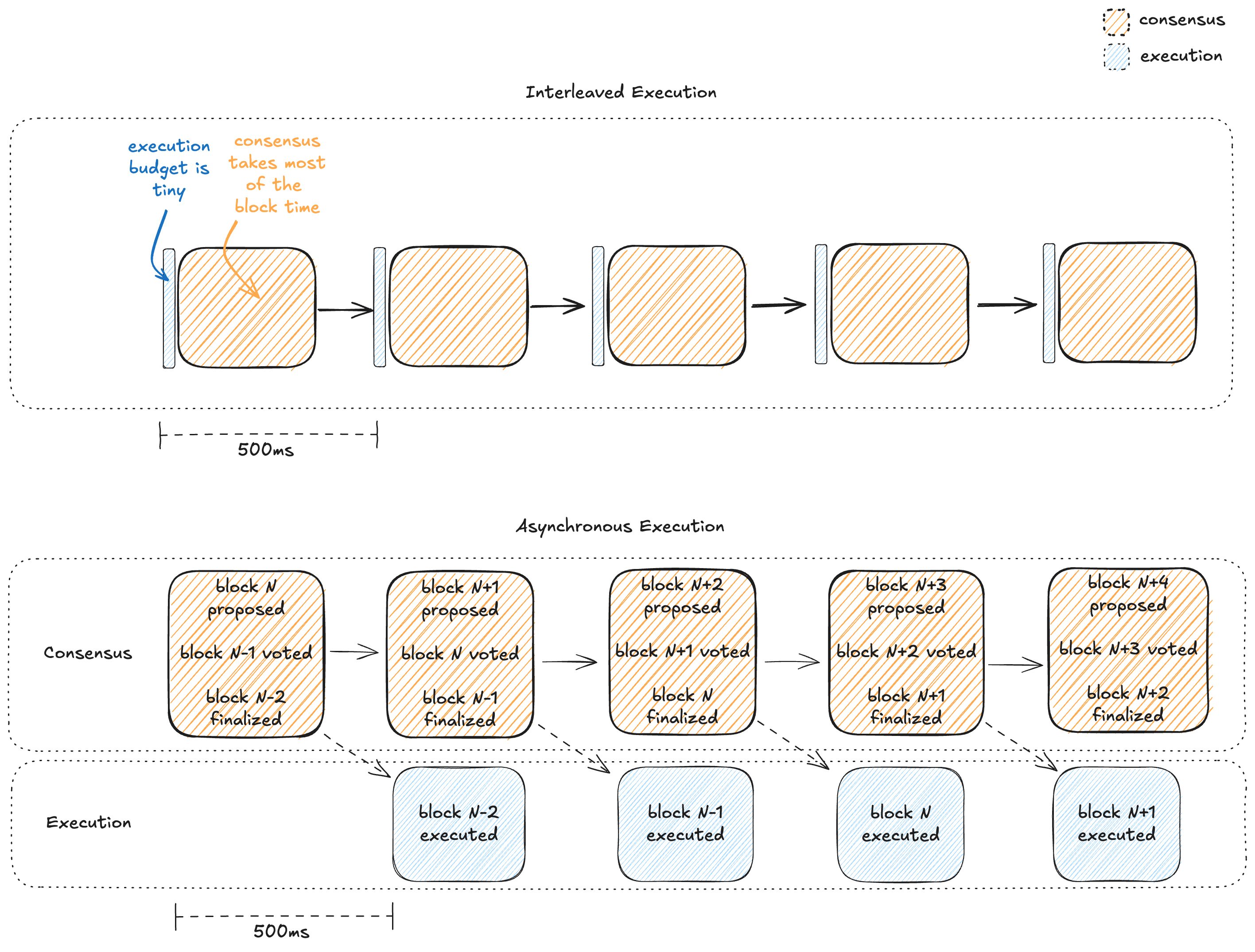

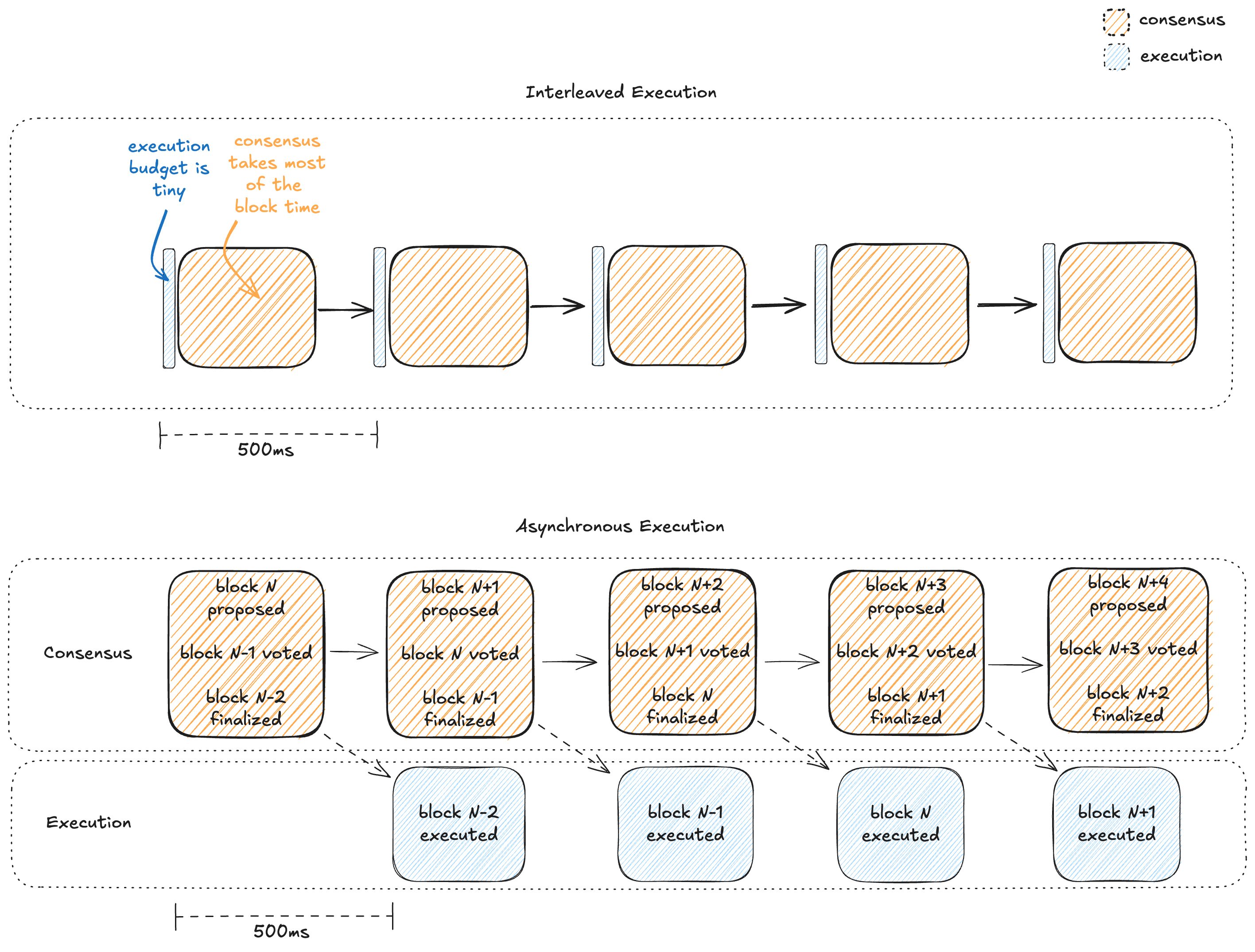

- Asynchronous Execution: Monad further separates the block-building process into two distinct stages: consensus and execution. Validators first agree on the order of transactions in a block (consensus) using MonadBFT. Then, the execution of these transactions (which includes the parallel processing) happens asynchronously in a separate pipeline. This separation prevents slow, complex transactions from delaying the entire network’s consensus process, allowing the chain to consistently produce blocks at a rapid pace (as fast as 400ms block times) while the execution engine efficiently processes the previous block.

Interleaved Execution vs Asynchronous Execution – Source: Monad

Technical Architecture

Monad’s performance engine is only possible because the team has custom-built every layer of the blockchain stack. Such comprehensive optimization, from the database to the networking protocol, is what truly sets Monad apart from other EVM-compatible chains.

Technical Architecture – Source: DeSpread, Monad

Full EVM Bytecode Compatibility

The decision to maintain full EVM compatibility is strategic. It means Monad’s Virtual Machine can execute the exact same bytecode as the Ethereum Virtual Machine.

Developers who built on Ethereum can move their dApps, smart contracts, and entire codebases to Monad without needing to rewrite a single line of code. This dramatically lowers the barrier to entry for the massive existing Ethereum developer ecosystem.

Monad supports the same wallet interfaces, RPC methods , explorers (like Etherscan), and developer tools (like Hardhat and Truffle) that the industry already uses. Developers gain the benefit of extreme performance without sacrificing their familiar tools.

MonadDB: The Custom State Database

Parallel execution creates a challenge: how do you allow multiple transactions to read and write to the blockchain’s account balances and smart contract variables at the exact same time without corruption? The solution lies in MonadDB, a specialized database designed for the Monad client.

Normally, traditional databases struggle with the Merkle Patricia Trie (MPT), a specialized data structure used by EVM chains to store state. MonadDB is engineered to handle MPT data efficiently. It allows multiple parallel execution threads to access and modify different parts of the state simultaneously, ensuring that high-throughput parallel execution runs without data bottlenecks.

Moreover, MonadDB efficiently stores most of the blockchain’s state on SSD storage rather than requiring expensive RAM. This crucial optimization lowers the hardware specifications needed to run a validator node.

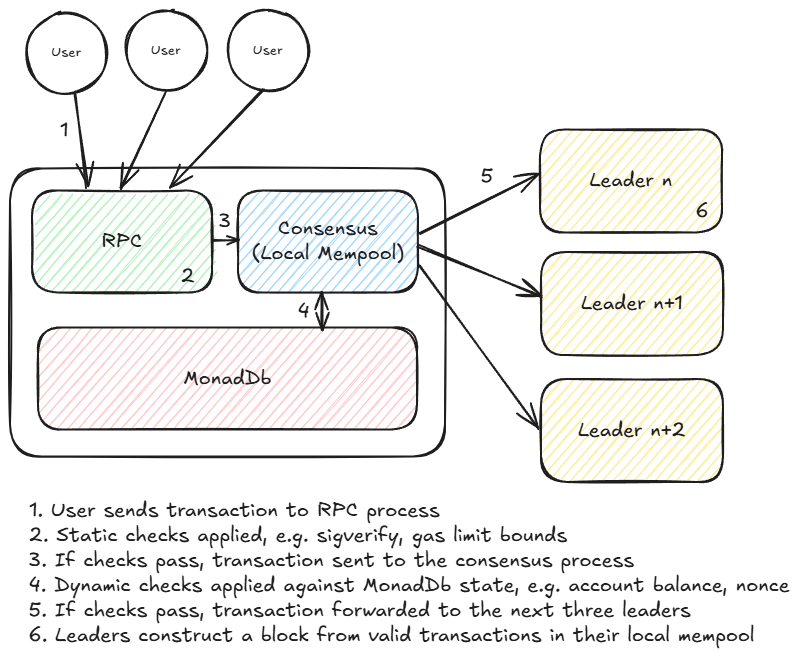

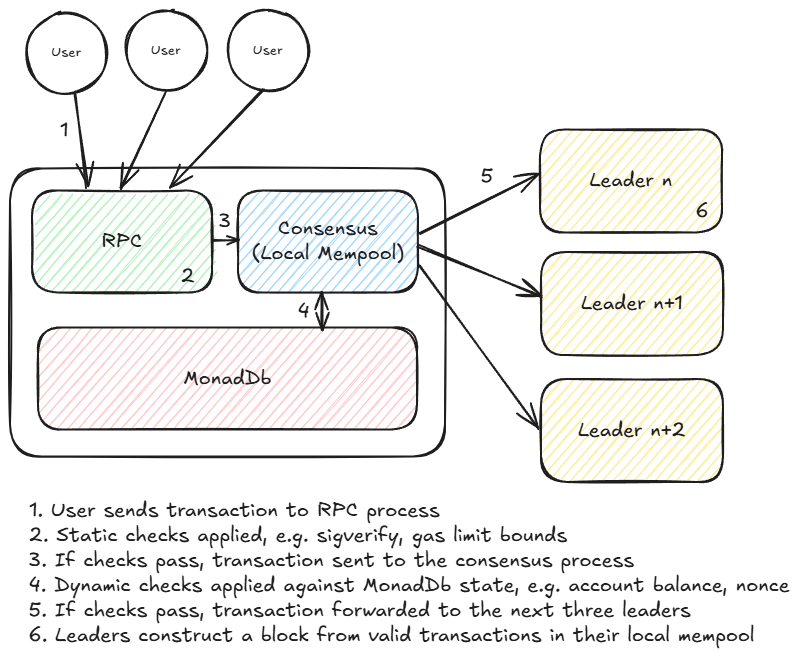

Local Mempools and Directed Forwarding

Monad overhauls the way transactions enter the network by eliminating the traditional global mempool. Most blockchains rely on a gossip protocol, where transactions flood the entire network to reach every node. This creates immense bandwidth consumption and propagation delays.

Monad also replaces the global pool with local mempools maintained by each validator. RPC nodes which users interact with directly forward a transaction to the few upcoming validators (leaders) scheduled to propose the next few blocks.

The “directed forwarding” method drastically reduces network bandwidth usage and ensures faster transaction inclusion. Transactions go directly to the nodes that matter, improving overall efficiency and reducing latency.

Local Mempools and Directed Forwarding – Source: Monad

What Does It Solve?

Monad addresses the most painful friction points in the existing blockchain ecosystem, creating a platform capable of handling real-world, high-volume applications.

Solving the EVM Bottleneck

Ethereum and its earliest Layer 1 competitors built their systems around sequential execution. As decentralized finance, gaming, and social dApps grew, the limitations became glaringly obvious. Network congestion forces users into priority gas auctions, making transactions prohibitively expensive. In addition, long block times and slow finality frustrate users, making simple actions feel sluggish and unreliable.

Monad directly solves these issues by proving that an EVM-compatible chain does not need to sacrifice performance. By allowing tasks to run at the same time and not waiting for each one to finish before starting the next, Monad boosts the network’s capacity by 1000 times, leading to very low fees The capacity makes complex, resource-intensive dApps, such as sophisticated derivatives exchanges, on-chain high-frequency trading, and fully decentralized MMO games, feasible for the first time on a fully EVM-compatible chain.

Bridging the Performance-Decentralization Gap

Many high-speed L1 chains achieve their speed by compromising on decentralization. They may require validator nodes to run costly, specialized hardware, thus limiting the number of people who can participate in securing the network.

Monad’s architecture, thanks to MonadDB’s storage optimization and the efficient MonadBFT consensus, maintains high performance while keeping the hardware requirements for nodes low.

Empowering Developers and Ecosystem Growth

The choice of full EVM bytecode compatibility is Monad’s biggest play for developer mindshare. For a seasoned Ethereum developer, migrating a protocol to Monad is simpler than moving to a blockchain that uses an entirely different programming language (like Rust on Solana or Aptos). This drastically accelerates ecosystem growth, allowing Monad to rapidly attract established DeFi protocols and a wave of new builders looking for an ultra-fast execution environment.

Tokenomics

MON is the native token of the Monad blockchain. Its design is vital for network security, incentivizing participation, and driving ecosystem development. MON serves three primary functions:

- Transaction Fees: Users pay all gas fees in MON, which compensate validators for processing transactions. The fee structure includes a burn mechanism, similar to Ethereum’s EIP-1559, permanently removing a portion of the base fee from the supply. This deflationary pressure helps balance the inflationary validator rewards, supporting the token’s long-term value.

- Staking: As a PoS chain, Monad requires MON holders to stake their tokens (directly or by delegating to validators) to secure the network. In return, they earn staking rewards (newly minted MON) and a share of the transaction fees, aligning incentives and penalizing malicious actions via slashing.

- Governance: MON functions as the governance token for the Monad DAO. Holders can propose and vote on key decisions affecting the protocol’s future, such as changes to network parameters, funding initiatives, and treasury management.

In terms of token distribution and unlock schedule, detailed token allocation charts remain a closely guarded secret ahead of the Mainnet.

Learn more: Monad Confirms MON Airdrop Date, Allocation Rules Still a Secret

Team, Investors, and Market Position

Monad’s foundation of experience and capital positions it as a significant contender in the Layer 1 race.

A team of former high-frequency trading experts from Jump Trading founded Monad Labs in 2022. The co-founders, including CEO Keone Hon, CTO James Hunsaker, and COO Eunice Giarta, bring a special kind of expertise in building ultra-low-latency distributed systems.

Monad has secured significant backing from some of the largest and most influential venture capital firms in the crypto industry. In April 2024, Paradigm led the project in successfully raising a massive $225 million in a Series A funding round. Other notable investors include Electric Capital and DragonFly Capital. Such a substantial capital injection provides Monad with the resources necessary to scale its engineering efforts, grow its ecosystem, and compete aggressively for developers and users. The funding round instantly established Monad as one of the best-capitalized Layer 1 projects in the space.

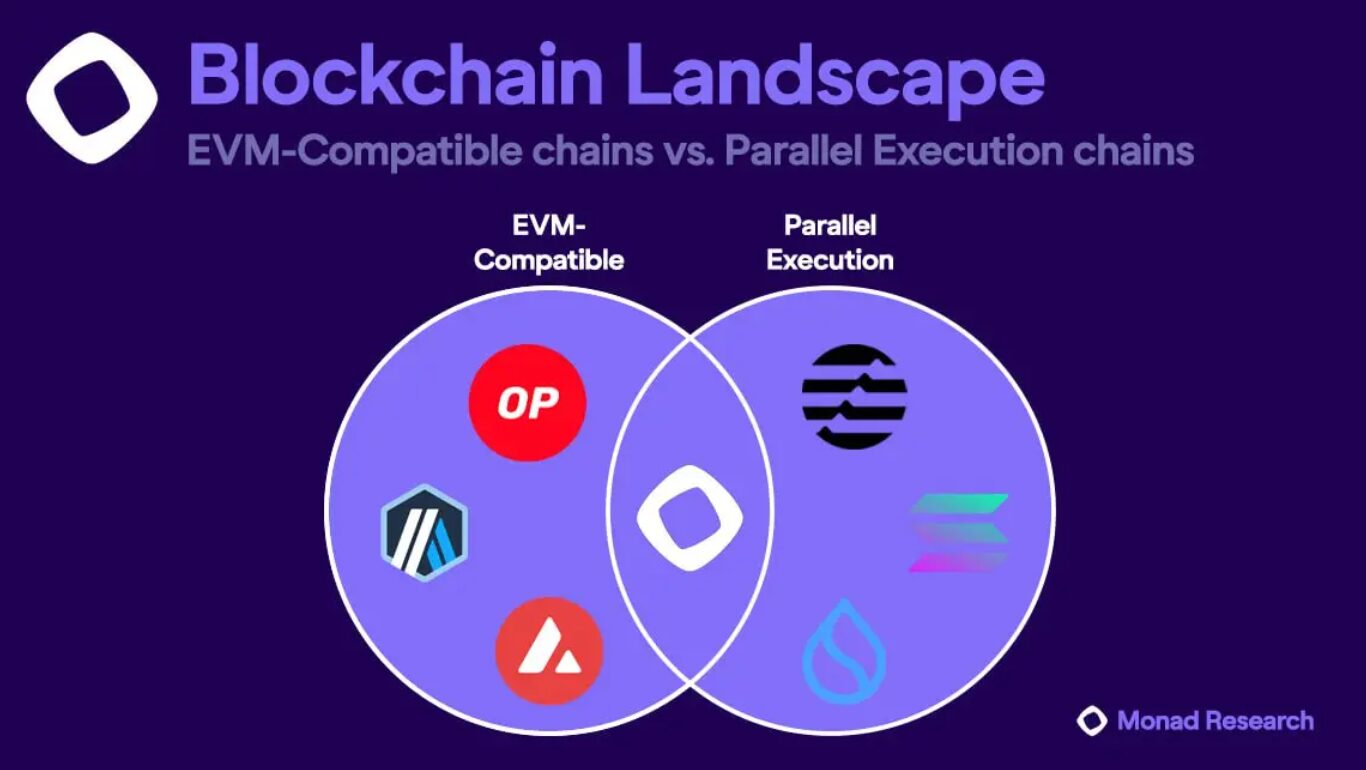

Monad enters a competitive landscape, often measured against three main types of competitors:

- Existing EVM L1s (Ethereum, Avalanche, Binance Smart Chain): Monad directly competes with these networks by offering a drop-in replacement that retains compatibility while delivering vastly superior performance. Its core value proposition is to attract dApps struggling with congestion and high fees on the older chains.

- Non-EVM High-Performance L1s (Solana, Aptos): These chains achieve high TPS by using non-EVM architectures. Monad competes by matching or exceeding their speed benchmarks while offering the crucial benefit of EVM compatibility, making developer migration significantly easier.

- Layer 2 Scaling Solutions (Arbitrum, Optimism): L2s aim to scale Ethereum by processing transactions off-chain. Monad competes as a base layer solution that offers composability and real-time censorship resistance in a way that L2s cannot always guarantee, providing an ultra-fast base layer for the entire EVM ecosystem.

Monad in the blockchain landscape. – Source: Monad

FAQ

Is Monad Compatible With Ethereum?

Yes, Monad is fully EVM bytecode-compatible, which allows developers to deploy existing smart contracts from Ethereum and other EVM chains onto Monad without requiring any code changes.

How Fast Is Monad?

Monad is engineered to achieve a target throughput of 10,000 TPS, with extremely fast finality of approximately 800 milliseconds, making it one of the fastest EVM-compatible chains in development.

What Is “Parallel Execution”?

Parallel Execution is Monad’s method of processing transactions. Unlike traditional blockchains that process transactions one after the other (sequentially), Monad runs many independent transactions simultaneously. This dramatically increases the number of operations the chain can handle in a given timeframe, leading to higher throughput and lower fees.

Does Monad Have A Token And What Is Its Ticker?

Yes, Monad’s native cryptocurrency and governance token is expected to have the ticker MON. Users will need MON to pay for gas fees, stake to secure the network, and participate in governance.

Learn more: Hyperliquid Lists MON, Enabling Pre-Market Trading for Monad Token

Who Are The Main Investors In Monad?

Monad has secured significant backing, including a $225 million Series A funding round led by the prominent venture capital firm Paradigm. Other key investors include Electric Capital and DragonFly Capital.