Key takeaways

-

Crypto payment gateways enable businesses to accept cryptocurrency payments from customers.

-

They act as intermediaries, converting crypto payments into the business’s preferred currency (crypto or fiat).

-

Crypto payment gateways reduce transaction fees compared to traditional banking systems and provide access to a global customer base.

-

These gateways leverage blockchain technology to offer secure and faster transactions with fewer intermediaries, enhancing transparency and reducing the risk of fraud.

The cryptocurrency industry faces significant challenges, particularly in the area of seamless conversion between digital assets and fiat currencies. This issue makes it difficult for businesses and users to adopt cryptocurrencies for everyday transactions.

Crypto payment gateways address this need by simplifying the process of converting digital currencies into fiat, enabling smooth and efficient transactions.

This article explores what crypto payment gateways are, how these gateways work, and their pros and cons.

Cryptocurrency payment gateways, explained

A cryptocurrency payment gateway is a digital transaction facilitator that enables businesses to accept crypto payments while ensuring seamless processing and settlement.

These gateways act as intermediaries between customers who pay with digital assets and merchants who receive crypto payments, helping businesses navigate the complexities of blockchain transactions. Examples of crypto payment gateways include BitPay, Coinbase Commerce and PayPal’s crypto payment service.

One of the key advantages of using a crypto payment gateway is that businesses can receive payments in cryptocurrency while opting to convert them into fiat currency, which is then deposited into their bank accounts. This eliminates concerns about crypto price volatility while allowing merchants to offer additional payment options to their customers.

Are crypto payment gateways necessary for accepting digital currencies?

While crypto payment gateways simplify the process of accepting digital assets, they are not the only way for businesses to receive cryptocurrency payments.

Merchants can choose to accept crypto directly by using personal wallets, bypassing third-party processors. However, without a payment gateway, they would need to manually manage transactions, track payments on the blockchain, and handle currency conversion if they wish to receive fiat instead of crypto.

For businesses looking to integrate cryptocurrency payments alongside traditional methods, crypto payment gateways provide an efficient solution. These services offer real-time transaction processing, automatic conversion to fiat and additional security features that protect businesses from fraudulent transactions.

However, be aware of fees. Coinbase Commerce charges a 1% fee on all crypto payments. After your customer completes a payment, this fee is collected in the settlement currency of the transaction.

For example, if your customer makes a $250 purchase in Bitcoin (BTC), and your settlement currency is in euros, it would collect 2.5 euros (1% of the payment amount) as a fee.

Types of crypto payment gateways: Custodial vs. non-custodial

Crypto payment gateways can be classified into two main types: custodial and non-custodial. The choice between these options depends on a business’s preferences regarding security, control and ease of use.

Custodial crypto payment gateways

Custodial gateways function similarly to traditional payment processors. They receive and temporarily hold payments before allowing merchants to withdraw funds to their crypto wallets or convert them to fiat currency. This model is ideal for businesses that want a streamlined experience without dealing with direct wallet management.

Key characteristics of custodial payment gateways include:

-

Automated fiat conversion: Payments can be converted to local currency instantly, mitigating volatility risks.

-

User-friendly dashboard: Merchants can manage transactions, track payment history, and withdraw funds through an online portal.

-

Compliance features: Many custodial gateways implement Know Your Customer (KYC) and Anti-Money Laundering (AML) measures to meet regulatory requirements.

Non-custodial crypto payment gateways

Non-custodial payment gateways provide merchants with full control over their funds by immediately transferring payments to their wallets without holding them on behalf of the business. These solutions prioritize decentralization and security, allowing merchants to manage their own private keys.

Key characteristics of non-custodial payment gateways include:

-

Enhanced security: Funds are not stored by the gateway, which reduces the risk of hacks or third-party control.

-

Direct crypto transfers: Payments are sent straight to the merchant’s wallet, which eliminates withdrawal processes.

-

Greater privacy: Merchants can accept payments without undergoing extensive KYC verification.

-

Lower fees: Transaction costs are reduced for both parties since no intermediaries are involved.

-

Increased transparency: The blockchain records transactions, providing an immutable and traceable record.

-

Full control over funds: Merchants retain complete ownership and access to their crypto assets.

Did you know? Major banks and fintechs, including Bank of America, Standard Chartered, PayPal, Revolut, and Stripe, are entering the stablecoin market to enhance cross-border payments.

How do crypto payment gateways differ from traditional fiat payment gateways?

Traditional payment gateways, such as those used for credit card processing, facilitate transactions in government-issued currencies like the US dollar or euro. These fiat gateways connect a merchant’s payment system to a bank, verifying transactions based on the customer’s bank details before authorizing or declining payments.

Key distinctions between fiat and crypto payment gateways include:

-

Currency type: Fiat gateways exclusively process national currencies, whereas cryptocurrency gateways support digital assets like BTC, Ether (ETH) and stablecoins.

-

Decentralization: Traditional payment gateways rely on centralized financial institutions, while crypto payment gateways leverage blockchain technology for peer-to-peer transactions.

-

Transaction speed: Crypto payments can be settled in minutes, whereas fiat transactions, especially international payments, may take days to clear.

-

Chargeback protection: Unlike fiat payments, where chargebacks can be issued, crypto transactions are irreversible once recorded on the blockchain.

While fiat payment gateways remain essential for conventional banking transactions, crypto payment gateways are expanding payment possibilities by integrating blockchain-based financial solutions.

As cryptocurrency adoption continues to grow, businesses must evaluate their payment strategies and choose the right gateway solution that aligns with their operational needs.

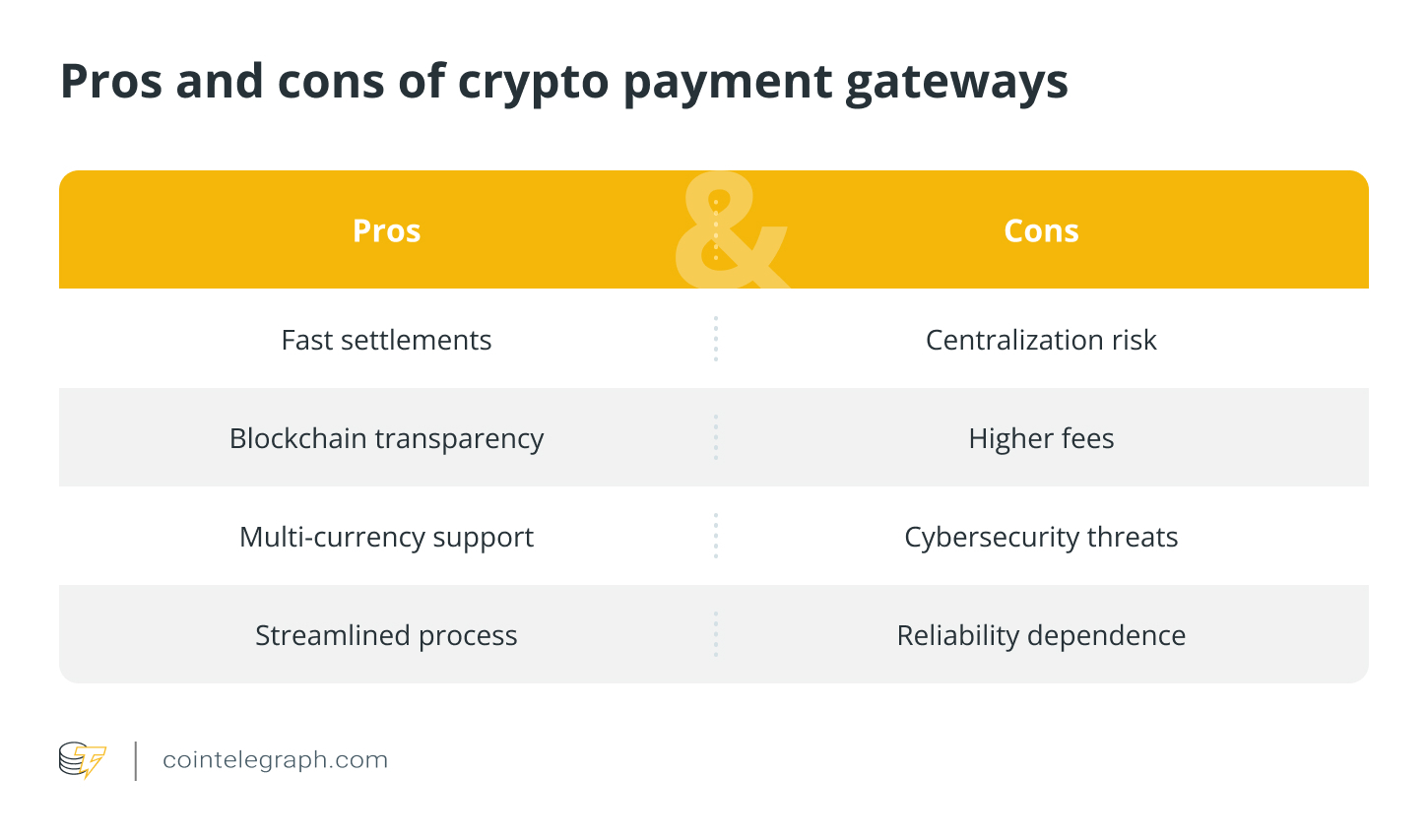

Pros and cons of cryptocurrency payment gateways

You must be aware of the pros and cons of cryptocurrency payment gateways before using them, whether for business transactions or everyday personal use.

Pros of crypto payment gateways

One of the major advantages of using cryptocurrency payment gateways is the ability to settle transactions quickly. These platforms typically charge a minimal network fee (covered by the service provider) and a small service fee for customers. The streamlined process involves just one intermediary — the crypto payment processor — which enhances the user experience for both businesses and their clients.

Additionally, crypto payment systems benefit from the transparency of blockchain technology, offering protection for merchants against chargeback fraud. Unlike traditional fiat payment systems, where transactions can sometimes result in businesses not receiving the funds after they have been deducted from a customer’s account, crypto payments provide more certainty. Furthermore, these gateways can handle a variety of cryptocurrencies, mitigating the risk of market volatility for merchants.

Cons of crypto payment gateways

However, crypto payment gateways are still intermediaries in the process, meaning settlements are not fully decentralized. This centralization could pose a risk. For instance, if a crypto payment processor experiences operational disruptions, merchants may face delayed payments until the issue is resolved. Similarly, if the gateway is compromised by a cyberattack, businesses may lose access to their funds.

Another downside is that crypto payment gateways can be more expensive than direct blockchain transactions. Since these gateways act as intermediaries, they add their own fees on top of the blockchain network’s transaction costs.

As centralized entities, crypto payment processors introduce a level of trust. Merchants need to ensure that the processor is capable of offering reliable, secure services to prevent potential cyber threats.

Do cryptocurrency exchanges offer payment gateways?

Binance, Coinbase and Kraken, which are centralized cryptocurrency exchanges, provide payment gateways to facilitate crypto transactions.

Additionally, they offer application programming interfaces (APIs), which enable merchants to create custom checkout pages with full design control. APIs act as software intermediaries that allow different applications to communicate seamlessly.

Binance offers a crypto payment solution called Binance Pay, tailored for businesses that are open to accepting digital currency. Merchants can integrate Binance Pay both online and in physical stores.

By displaying a unique QR code, physical stores can offer a secure and contactless crypto payment option, enhancing customer convenience. For online businesses, Binance Pay allows seamless cross-border transactions, providing customers with more diverse payment options. Merchants can either create a merchant account or work with channel partners to start accepting crypto payments via Binance Pay.

On the other hand, Coinbase offers its own payment gateway, Coinbase Commerce, which supports 10 different digital currencies, including ETH, USDC (USDC), Dogecoin (DOGE), Tether’s USDt (USDT) and Litecoin (LTC).

Payments processed through Coinbase Commerce are instantly converted to US dollars, ensuring stability for merchants. Importantly, Coinbase does not have access to any funds deposited into merchant accounts.

If a merchant loses their 12-word recovery phrase, Coinbase is unable to assist in retrieving the lost assets. Additionally, Coinbase applies a 1% fee on transactions before the funds are transferred to the merchant’s account, as mentioned above.

Kraken Pay is a cryptocurrency payment processor that allows businesses to accept a wide range of digital currencies, offering fast and secure transactions. It provides easy integration with Kraken exchange wallets, low fees and the ability to convert crypto to fiat, but it still relies on centralized trust.

Did you know? In March 2022, MoonPay enabled customers to purchase NFTs directly through marketplaces, simplifying the process by integrating traditional payment methods like credit cards and Apple Pay.

Are crypto payment gateways secure?

When selecting a cryptocurrency payment gateway, merchants should carefully evaluate how the provider manages the storage of cryptocurrencies and fiat funds.

It’s important to review factors such as transaction fees, the variety of supported cryptocurrencies and the platform’s history regarding security breaches or scams. Understanding these elements helps merchants make informed decisions about which gateway aligns with their needs.

In addition, ensuring that the crypto payment gateway offers reliable customer support is essential. Having access to prompt and effective assistance is crucial in case of disruptions or issues with payments. A responsive support team can help resolve problems quickly and minimize downtime for businesses.

Finally, merchants should always check the reputation of a payment gateway before committing. Consulting specialized review sites and reading feedback from other users will provide insights into the platform’s reliability and trustworthiness. Thorough research ensures that merchants select a secure and reliable payment processor for their business.

将家用烤架变成了烹饪重量级-120x86.jpg)